Jobless claims were little changed last week

Coming off the Fed meeting yesterday, today’s jobless claims reinforced their assessment of the state of the economy and labor market, which has shown surprising resilience in the face of the fastest rate tightening cycle in decades. While policymakers remain content to stand pat for now, the central bank’s short-term policy rate remains at its highest level since the global financial crisis in 2008.

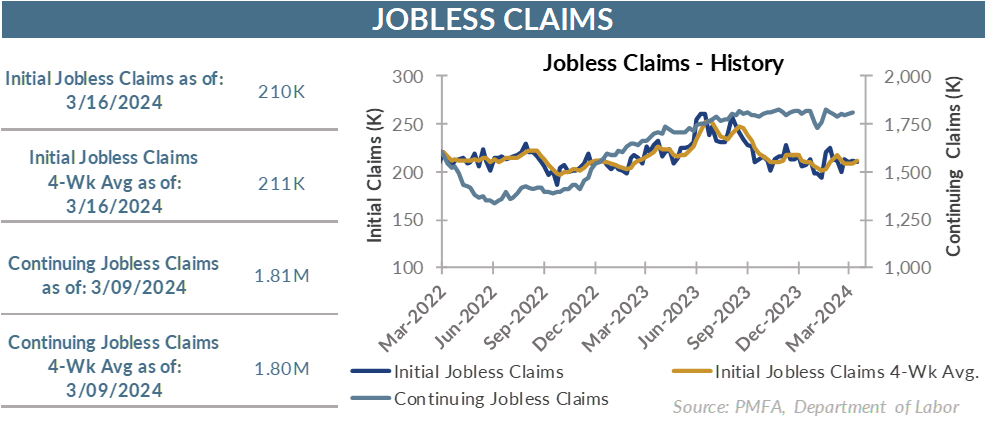

First-time unemployment claims were virtually changed last week, edging modestly upward to 210,000 from a downwardly revised 209,000 for the prior week. The flow of claims has been relatively stable for some time, showing no indication of a sustained uptick in layoffs.

Other indicators of the state of the labor market indicate clearly that conditions have come off the boil but remain quite solid. Job openings are down notably from their cyclical peak but remain well above the high end from the last expansion. Voluntary turnover is down, suggesting that fewer workers are looking to move on or up from their current jobs. The pace of job creation has slowed but is still in a constructive range consistent with solid economic growth.

Against that backdrop, wage growth remains elevated, one of the factors that’s keeping the risk of inflation center stage for the Fed. Inflation has receded considerably since 2022 but has been rangebound well above the Fed’s 2% target since last fall, with limited signs of progress. Shelter costs play an outsized role in the index and have thus far remained elevated. Other measures of housing and rental inflation are already showing greater signs of a marked slowdown in the pace of price increases; that’s expected to flow through to CPI over time.

For now, the soft-landing thesis is intact, with leading indicators showing nascent signs of trending more positively. Given Fed Chair Jay Powell’s comments yesterday and the revisions to the FOMC’s summary of economic projections, the Fed is leaning into patience and pragmatism over a more doctrinaire approach to their inflation mandate.

The FOMC’s updated projections suggest a willingness by policymakers to trim their policy rate over the duration of the year even with inflation remaining stickier than previously anticipated in hopes of navigating the economy to a midcycle soft landing — a goal that has vexed many of their predecessors over time.

The bottom line? Jobless claims data tells just one part of the story of the labor markets but a timely one. Employers may not be hiring as aggressively as they were, but there’s little evidence of an uptick in layoffs. For now, the soft-landing scenario is still alive, leaving little reason for employers to preemptively slash their payrolls, particularly given the challenges many faced to find workers in recent years.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.