Where does inflation stand today relative to the Fed's goal?

Inflation remains firmly in the crosshairs for the Fed as arguably the key variable driving the intermediate-term outlook for monetary policy. Without increased confidence that inflation will stay sustainably lower, central bankers are unlikely to cut rates. So where is inflation today relative to the Fed’s target?

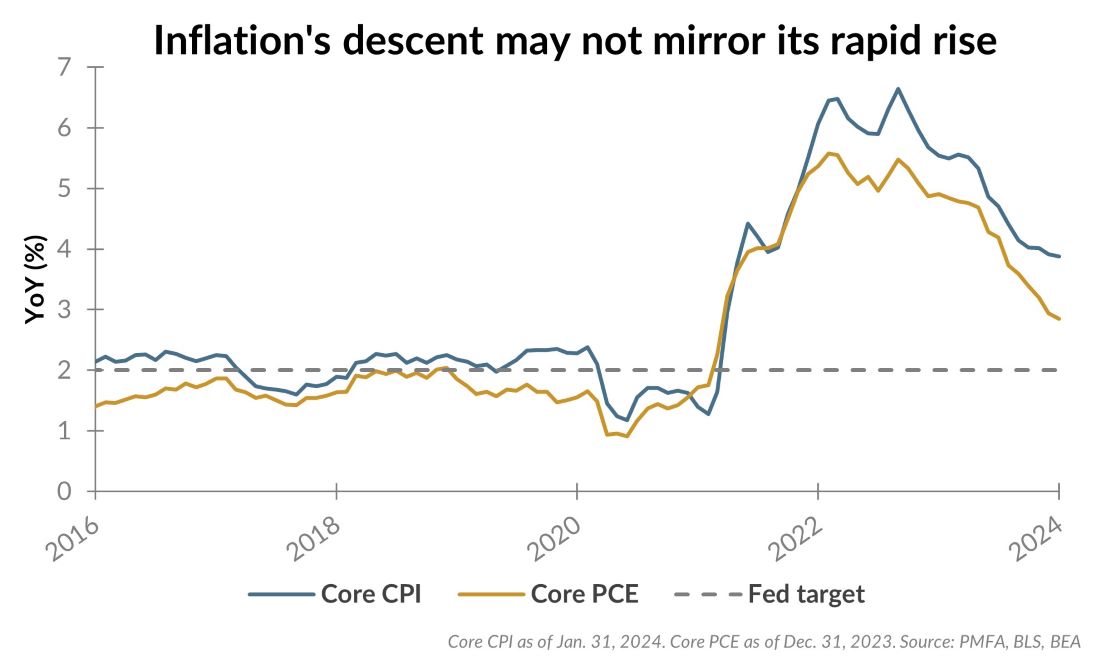

As shown in the chart above, inflation has been steadily falling since late 2022, but it remains well above the Fed’s 2% target. Through January, the consumer price index (CPI) was up 3.1% over the prior 12 months. However, core CPI, which strips out the more volatile food and energy prices, remains comparatively elevated — rising nearly 4% over that same period. An alternative measure preferred by the Fed (Core PCE) was also up 2.8% over the past year — better, but still well over the central bank’s 2% goal.

Recent inflation data have provided evidence that single-month price increases have continued to decelerate. However, sticky wage growth, persistently high shelter cost increases, easy financial conditions, and strong economic growth all contribute to the risk that the path back to 2% inflation could be drawn out longer than anticipated. In prior cycles, a second bout of rising inflation has often followed the initial surge — something the Fed’s hoping to avoid this time. Fed Chair Powell has been clear that they want to see additional data, confirming inflation has moved sustainably lower before any cut. Investors will be watching for those signs closely in the months ahead.

The bottom line? Inflation has faded but remains a meaningful consideration for investors as they try to anticipate when and how quickly the Fed can begin to ease.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.