Inflation continues to recede, but it remains a slow grind lower.

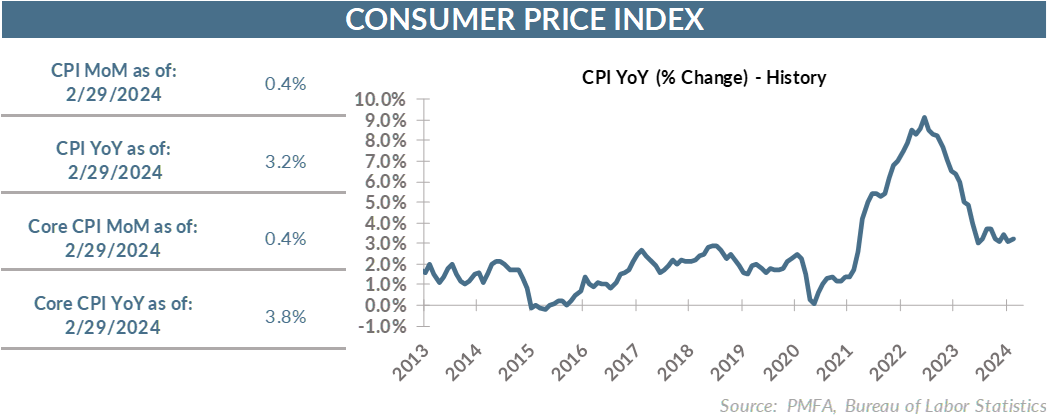

The consumer price index popped higher in February, rising by 0.4% — a result that was in line with expectations but was still the largest single-month increase in five months. On a trailing 12-month basis, the index edged up to 3.2%.

A modest increase in the CPI isn’t enough to break the longer-term disinflationary trend, but it does reinforce the difficulty that a return to a more normalized inflation environment presents. The index has now been stuck in a relatively narrow range since October, with limited signs of tangible progress toward the Fed’s 2% target since late summer.

The slow recent progress on the path to 2% is underscored by the relative stickiness of core inflation, which continues to run above the headline number. One-year core inflation edged fractionally lower to 3.8% but has declined by less than a quarter point since October.

Underlying the headline number was a mixed bag of details. Food costs were unchanged for the month, and the 12-month increase has receded to 2.2%. That may be small consolation for households still absorbing the significant increase in the cost of food over the past few years. Grocery prices aren’t falling, but a more stable price environment provides a ray of hope that the worst of the price increases have passed.

Energy prices jumped by 2.3% on higher gas prices, but the increase wasn’t enough to lift the one-year number out of contractionary territory. Energy prices have fallen by nearly 2% over the past 12 months.

The more troubling aspects of the persistent upward pressure on prices lie in the service sector, largely reflecting strong wage growth and rising housing costs.

Shelter costs rose by 0.4% in February, which was a weaker increase than January’s hot 0.6% print but still reflective of uncomfortably strong gains in the cost of housing. The February gain was also in line with the average increase over the last six months despite some month-to-month volatility in the print.

There’s still a broad expectation that shelter inflation should moderate in the coming months as the housing market has cooled and other indicators of rental rates have moderated considerably. It appears that it’s only a matter of time before that moderation is reflected in the CPI, but it’s been long expected. Clearly, housing is off the boil of a few years ago, but housing inflation remains well above its roughly 3.5% pace during the pre-pandemic period.

While clearly illustrating that the Fed’s work to rein in inflation isn’t done, the report isn’t likely to carry much weight in its policy decision next week. No cut was expected coming into the report, and the heat that remains under prices won’t change that.

The greater question is the degree to which recently solid labor market data coupled with still excessive trend inflation will push the Fed’s first rate cut into the latter half of the year or if policymakers may feel that they’ve seen enough progress to slip in a cut in June. The March and April inflation prints will go a long way toward guiding that decision.

Policymakers have said that they want to see more evidence that the disinflationary trend is intact. What they may be specifically looking for remains intentionally ambiguous, but it’s unlikely that the February inflation report fits the bill.

The bottom line? The economy has come off the boil and inflation has eased considerably, but its more recent stickiness reinforces the difficult path to a more normalized 2% inflation environment. That could mean that the hopes that emerged last fall for rate cuts in the first half of 2024 were excessively optimistic. As has been the case for some time, the story — and the Fed’s decision — will come down to whether there are signs of meaningful progress in loosening up employment conditions and further signs of disinflation in the coming months.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.